dependent care fsa limit 2022

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. You may have.

2023 Transportation And Health Fsa Limits Projected Mercer

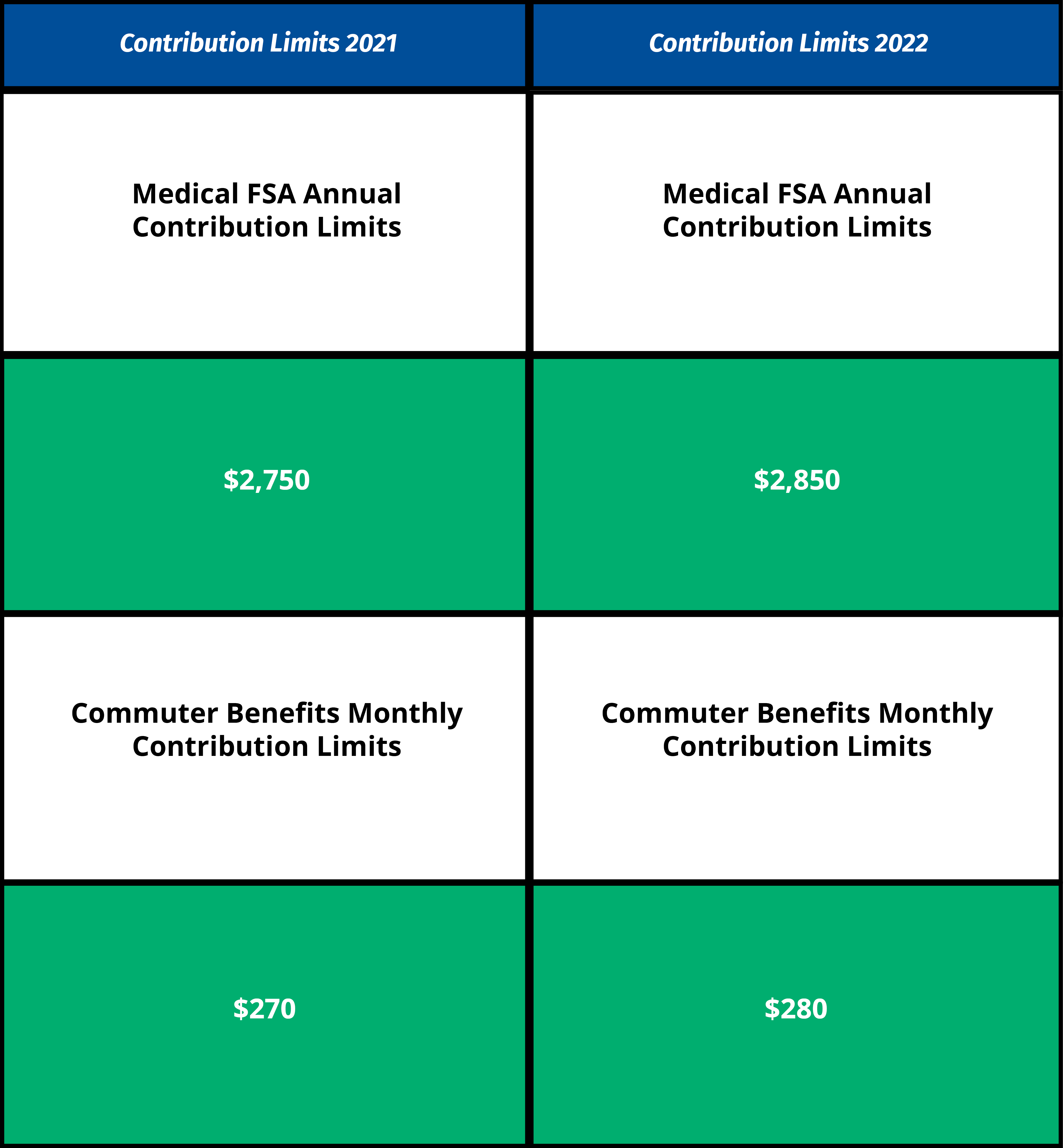

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

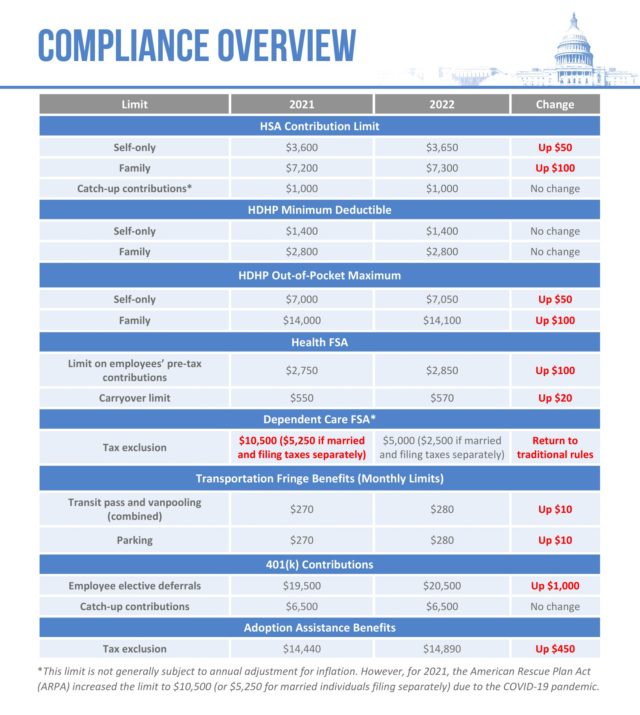

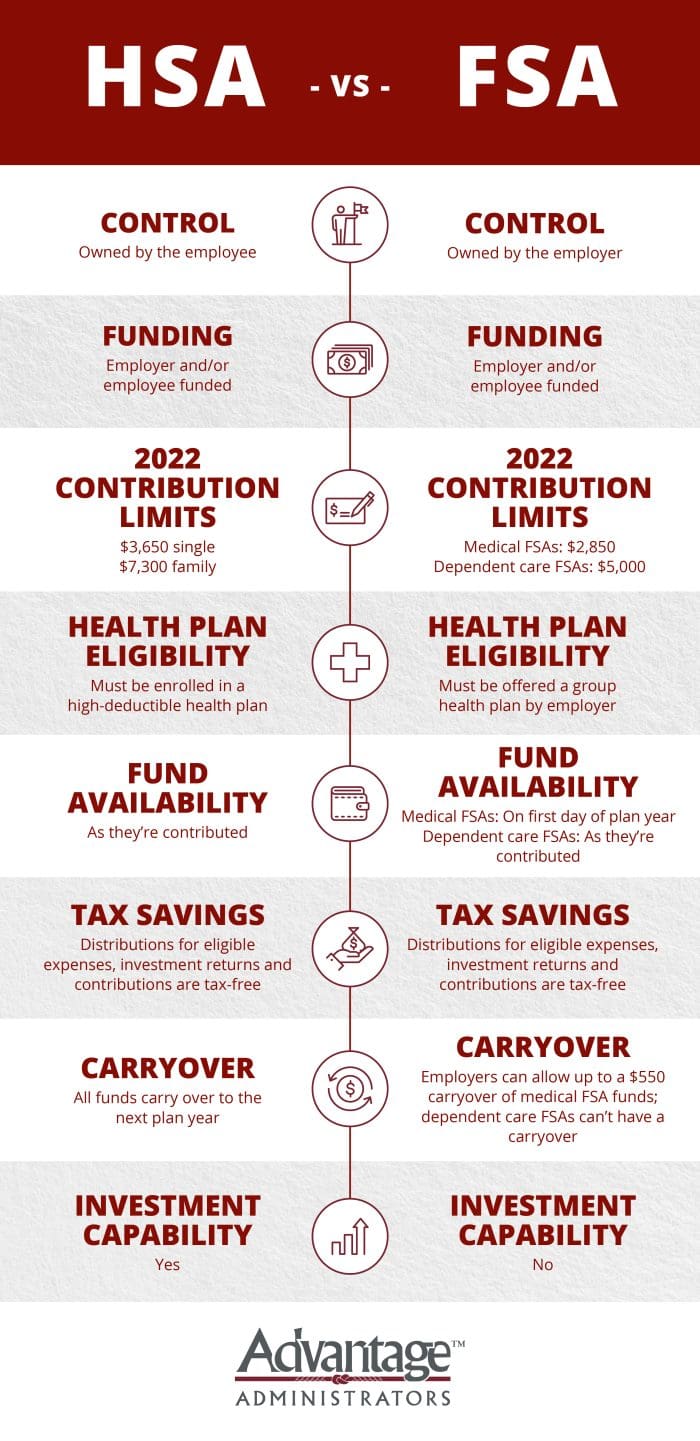

. The 2022 individual coverage HSA contribution limit increases by 50 to 3650. Its a smart simple way to save money while taking care of your loved ones so that you can continue to work. That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000.

The minimum annual election for each FSA remains unchanged at 100. The 2021 Dependent Care FSA limits came in response to the COVID-19 pandemic as a temporary relief to working parents. See below for the 2022 numbers along with comparisons to 2021.

The HCFSALEXHCFSA carryover limit is 20 percent of the annual contribution limit. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. There are some qualifications to be eligible to take advantage of the full amount.

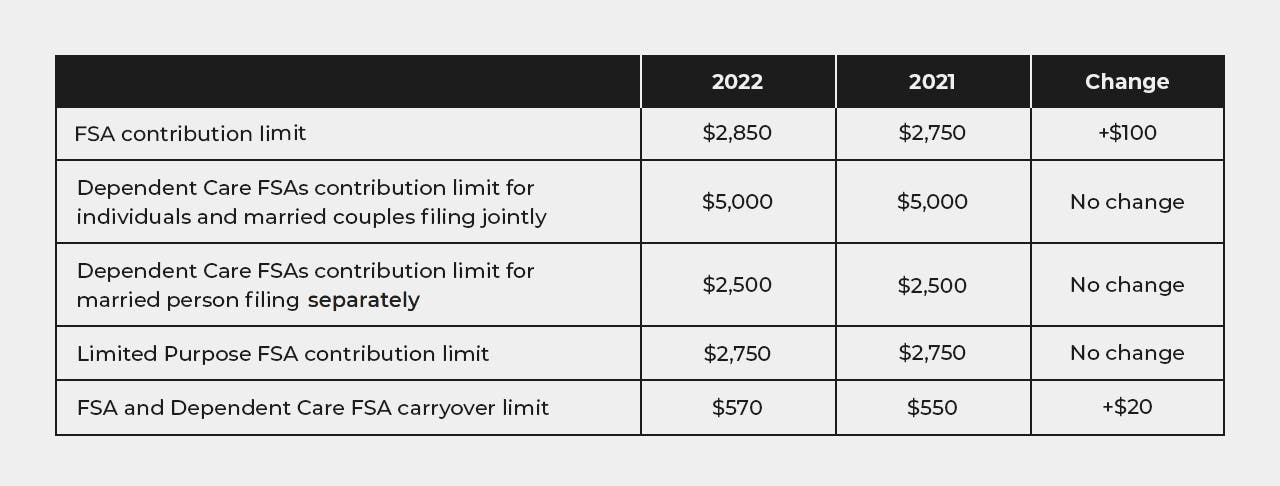

Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. The 2022 Dependent Care FSA contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022.

For 2022 the IRS caps employee contributions to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. Your Dependent Care Flexible Spending Account. 3No 1099-MISC is needed.

Dependent Care Assistance Plans Dependent Care FSA annual maximum if married filing separately. If you are divorced only the custodial parent may use a dependent-care FSA. The extra 1000 will be taxed as regular income- but Turbo Tax will report the.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycare. The carryover limit is an increase of 20 from the 2021 limit 550. Under a temporary pandemic relief change however all funds in dependent care accounts may be.

Double check your employers policies. As set by the internal revenue code the dependent care fsa limits for 2022 are 5000 for married filing jointly or single and 2500 for married filing separately. If you have a dependent care FSA pay special attention to the limit change.

The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. For 2022 and beyond the limit will revert to 5000. To be clear married couples have a combined 5000 limit even if each has access to a separate dependent care FSA through his or her employer.

For 2022 it remains 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately. This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA. But the late announcement left many.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. Employers can choose whether to adopt the increase or not. The IRS limits the annual maximum amount you can deposit in your dependent care FSA to 5000.

The most money in 2021 you can stash inside of a dependent-care FSA is 10500. For many of todays families the need for dependent care has become a fact of life. IRS Tax Tip 2022-33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

The limit is expected to go back to 5000. It remains at 5000 per household or 2500 if married filing separately. 4Yes you will have to provide the Child Care provider information her social security number on the Form 2441- when you have the Dependent Care Benefits you are required to report the information like the Dependent Care benefits.

The carryover limit is an increase of 20 from the 2021 limit 550. With dependent care accounts there traditionally has been no grace period or carry-over option. Dependent Care Fsa Limit 2022.

The IRS sets dependent care FSA contribution limits for each year. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. The limit will return to 5000 for 2022.

It you are. The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to. Extend the maximum age of eligible dependents from 12 to 13 for dependent care fsas for the 2020 plan year and unused amounts from the 2020 plan year carried over into the 2021 plan year or for plans for which the end of the last regular enrollment period that occurred on or before january 31 2020 was for the 2019 plan year for the 2019 plan.

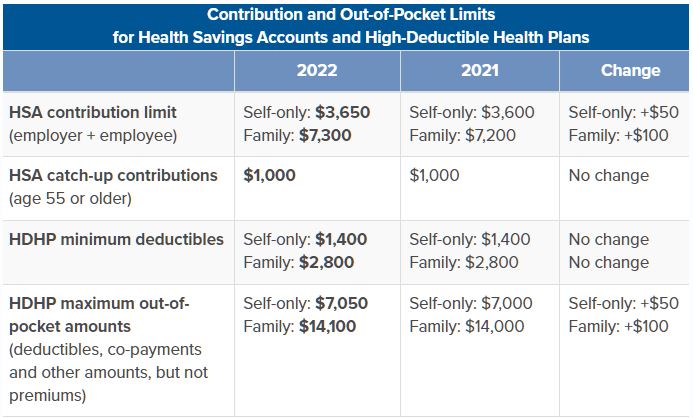

Dependent care FSA carryovers and extended grace periods under the CAA FSA relief do not affect employees subsequent plan year election or income exclusion limits. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The 2022 family coverage HSA contribution limit increases by 100 to 7300.

Medical mileage rate to obtain medical care reimbursable by a Health FSA.

What The New 2022 Hsa Limits Mean For You The Difference Card

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Hsa Dcap Changes For 2022 Blog Medcom Benefits

2022 Retirement Plan Contribution Limits

Employee Benefit Plan Limits For 2022

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Health Fsa And Other Limits Announced Paylocity

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Dependent Care Fsa Tax Consequences

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa See How You Ll Save With Each Advantage Administrators

Fsa And Hsa Limits In 2022 What S Changing Sportrx

What Is A Dependent Care Fsa Wex Inc

2022 Hsa Contribution Limits 2 Core Documents

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc